Category: trends

Why MultiFamily?

Why Multifamily?

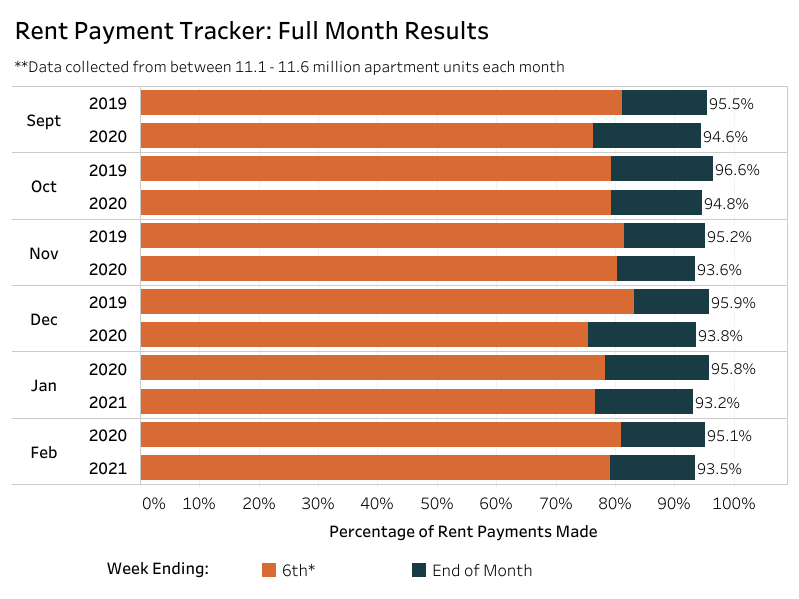

Everyone needs a place to live. For various reasons, Americans prefer to rent, instead of owning and maintaining a home. Every community has different types of multi-family that fit each type of tenant. According to CBRE, the largest commercial real estate services company in the world, multifamily properties weathered the 2020 recession better than most property sectors. (CBRE research).

Shift in Demand to Suburban living

In the past year, COVID related factors have impacted the urban markets more than the suburban market. Businesses have had to pivot their employees to working remotely and schools shifted to remote learning. Urbanites who were once willing to pay top dollar for less square footage and access to restaurants and entertainment venues, were beginning to feel confined in their apartments as COVID restrictions took place. Their desire shifted towards larger housing options and greater access to the outdoors. (based on MHN post by Greg Curci)

Our Investment Position

As a private equity firm, we have taken note of the changing trends and strong performance in the multifamily asset class. Stay tuned, as we investigate potential avenues of investment that will provide stable cash flow and relatively consistent returns. We are excited to play a part in improving communities for our residents and provide an alternate source of wealth for our investors.

Investment Trends to Watch for in 2021

Based on the article by Mike Aiken of Fogelman Properties for MHN (multi-housing news)

With potential vaccines available starting in 2021, the expectation is that economies will start to open up, contributing to improved job security later in the year. This would translate to more transactional activity in general.

Southeast housing markets will be in demand as economic bases have been very strong in those areas, providing jobs, an influx of population growth and demand for housing. As demand goes up, supply goes down and the price of these assets will increase.

As everyone looks forward to returning to a post-COVID world, we will have to see if the temporary demand for suburban properties will continue, or if urban dwellers who had been seeking refuge during the pandemic will return to the city.