Category: Investment

Why is creating a stream of passive income a MUST?

You may be one of the very few fortunate ones who are fulfilled through your job, or have the freedom and time to do all there is to be done to your heart’s desire. If so, then read no further and continue doing what you are doing.

However, if you are like us, spending 50 to 60+ hours a week at your job, balancing family life, kids’ academics, extracurricular activities… it gets a bit crazy. It doesn’t matter how much your salary is, the moment you lose the ability to work, that active income stream stops as well. That’s why creating a stream of passive income is so important.

Here are just a few things to think about:

- You have about 18 summers to spend with your children. How are you spending yours? Slaving away at your job?

- Instead of living below your means, how about enlarging your means?

- Your true worth is measured by how much more you give to others rather than what you take for payment.

- Money is neither good nor bad. It’s an inanimate object. Like a knife, it can save someone or it can kill someone.

Apartment investing generates true passive income, where one would invest in others’ deals and receive returns as a passive partner. It is ETEMA CAPITAL’s mission to help you build generational wealth through apartment investing.

Why MultiFamily?

Why Multifamily?

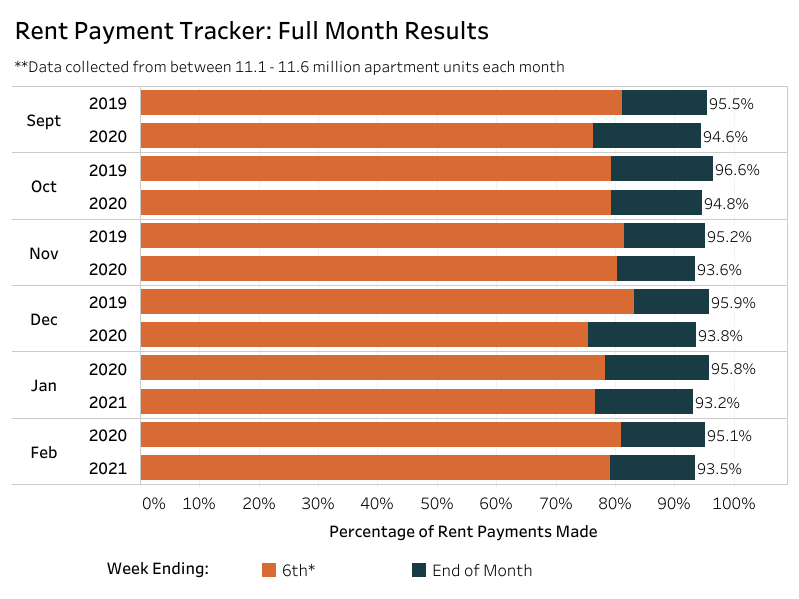

Everyone needs a place to live. For various reasons, Americans prefer to rent, instead of owning and maintaining a home. Every community has different types of multi-family that fit each type of tenant. According to CBRE, the largest commercial real estate services company in the world, multifamily properties weathered the 2020 recession better than most property sectors. (CBRE research).

Shift in Demand to Suburban living

In the past year, COVID related factors have impacted the urban markets more than the suburban market. Businesses have had to pivot their employees to working remotely and schools shifted to remote learning. Urbanites who were once willing to pay top dollar for less square footage and access to restaurants and entertainment venues, were beginning to feel confined in their apartments as COVID restrictions took place. Their desire shifted towards larger housing options and greater access to the outdoors. (based on MHN post by Greg Curci)

Our Investment Position

As a private equity firm, we have taken note of the changing trends and strong performance in the multifamily asset class. Stay tuned, as we investigate potential avenues of investment that will provide stable cash flow and relatively consistent returns. We are excited to play a part in improving communities for our residents and provide an alternate source of wealth for our investors.

Tax Benefits of Real Estate- Deductibility, Depreciable, Deferability

One of the most exciting things about investing in real estate are the tax benefits that the government has given to real estate owners. Before embarking on our real estate investing journey, I saw taxes just like my parents did: our duty as citizens of our country. As our W2 income went up, so did the amount of taxes we paid every year. At times, taking a minute to process the amount we paid in taxes was mind boggling. In our case, my husband is working solely for Uncle Sam from January until April every year. What about you?

Three tax perks, known to many real estate investors as the 3Ds (coined by Gary Keller, the founder of Keller Williams Realty) are: deductibility, depreciable and deferability.

Deductible- the tax law allows many different deductions for the normal upkeep for a property. These include deducting on basic expenses related to owning property: maintenance, improvements and even the interest on the mortgage, just to name a few. As an investor, there is a whole array of sophisticated strategies that are available to legally tap into, for tax deductions. Warren Buffet once said, ” You have to pay your taxes, but you don’t need to leave a tip.”

Depreciable- The tax law actually requires you to depreciate your property asset investments. Property is presumed to be depreciating over a number of years and each year that tax is reported, you follow a schedule from the IRS, to factor in and calculate for that “wear and tear”. Investors love this tax break because it allows them to reduce their taxable income through depreciation even though in reality, their property may be appreciating in value through appreciation!

Deferrable- one deferrable strategy is to do a 1031 exchange. In selling an investment property, tax law allows sellers to defer their taxes from the capital gains of one investment, if they reinvest and purchase another property. This has allowed many investors to realize the gain and reinvest it to acquire a bigger property (scale up) and defer the taxes. 1031 exchanges are a way investors have preserved their profits and accelerated their portfolio growth.

Knowing the 3Ds can change the way you see taxes. It’s exciting to see how much in taxes you can save through real estate investing. Imagine being able to take those savings and reinvest it to grow your portfolio! This is how many have reached FIRE (financial independence, retire early) and you can too!

To learn more, scroll all the way down to the bottom banner and sign up for our newsletter.

Investment Trends to Watch for in 2021

Based on the article by Mike Aiken of Fogelman Properties for MHN (multi-housing news)

With potential vaccines available starting in 2021, the expectation is that economies will start to open up, contributing to improved job security later in the year. This would translate to more transactional activity in general.

Southeast housing markets will be in demand as economic bases have been very strong in those areas, providing jobs, an influx of population growth and demand for housing. As demand goes up, supply goes down and the price of these assets will increase.

As everyone looks forward to returning to a post-COVID world, we will have to see if the temporary demand for suburban properties will continue, or if urban dwellers who had been seeking refuge during the pandemic will return to the city.

Why invest in real estate for wealth?

Real Estate has 3 immutable facts. Immutable facts are things that are true and will not change. The 3 immutable facts of Real Estate Investing are: 1) create cash flow growth, 2) build equity, 3) store wealth. In successful real estate investing, you make your money going into the investment deal. In so doing, you create cash flow – money that comes to you without having to labor for it. As you hold on to the investment, the property grows in value, which translates to the growth of your net worth. In the financial world, your net worth is like your report card- a measure of your success.

There are so many more added benefits as well: so many TAX BENEFITS built into real estate investing; different modes of investing to match the level of involvement an investor is comfortable with, and remarkable profits from disposition- multiple examples of money working hard to make more money for you.

We invite you to join us and start the journey towards investing in your financial freedom. (Contact us to be added to our newsletter.)