Category: financial knowledge

What is passive income?

Most of us earn income by trading our time and efforts for a set wage. Typically, the more time you spend at your job, the more money you can earn. It doesn’t matter how much your salary is, the moment you lose the ability to work, that active income stream stops as well.

Passive income is money that you acquire that’s not proportional to the time put into acquiring it. By creating a stream of passive income, you create stability, security, and freedom in your family’s financial life.

Apartment investing generates true passive income, where one would invest in others’ deals and receive returns as a limited partner. It is ETEMA CAPITAL’s mission to help you start building generational wealth through apartment investing.

Tax Benefits of Real Estate- Deductibility, Depreciable, Deferability

One of the most exciting things about investing in real estate are the tax benefits that the government has given to real estate owners. Before embarking on our real estate investing journey, I saw taxes just like my parents did: our duty as citizens of our country. As our W2 income went up, so did the amount of taxes we paid every year. At times, taking a minute to process the amount we paid in taxes was mind boggling. In our case, my husband is working solely for Uncle Sam from January until April every year. What about you?

Three tax perks, known to many real estate investors as the 3Ds (coined by Gary Keller, the founder of Keller Williams Realty) are: deductibility, depreciable and deferability.

Deductible- the tax law allows many different deductions for the normal upkeep for a property. These include deducting on basic expenses related to owning property: maintenance, improvements and even the interest on the mortgage, just to name a few. As an investor, there is a whole array of sophisticated strategies that are available to legally tap into, for tax deductions. Warren Buffet once said, ” You have to pay your taxes, but you don’t need to leave a tip.”

Depreciable- The tax law actually requires you to depreciate your property asset investments. Property is presumed to be depreciating over a number of years and each year that tax is reported, you follow a schedule from the IRS, to factor in and calculate for that “wear and tear”. Investors love this tax break because it allows them to reduce their taxable income through depreciation even though in reality, their property may be appreciating in value through appreciation!

Deferrable- one deferrable strategy is to do a 1031 exchange. In selling an investment property, tax law allows sellers to defer their taxes from the capital gains of one investment, if they reinvest and purchase another property. This has allowed many investors to realize the gain and reinvest it to acquire a bigger property (scale up) and defer the taxes. 1031 exchanges are a way investors have preserved their profits and accelerated their portfolio growth.

Knowing the 3Ds can change the way you see taxes. It’s exciting to see how much in taxes you can save through real estate investing. Imagine being able to take those savings and reinvest it to grow your portfolio! This is how many have reached FIRE (financial independence, retire early) and you can too!

To learn more, scroll all the way down to the bottom banner and sign up for our newsletter.

The Value of Tracking Net Worth

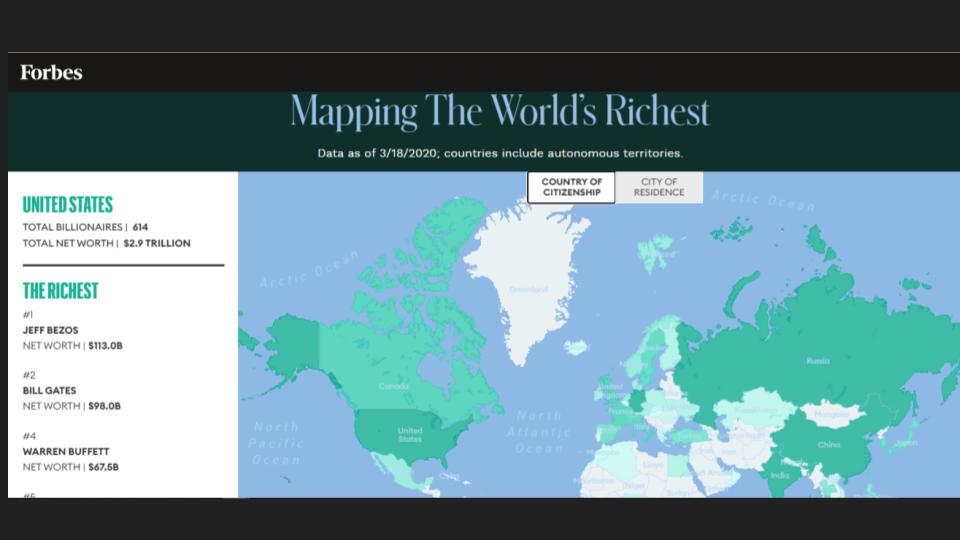

Every year, Forbes, a business magazine, publishes a list ranking the world’s wealthiest individuals. How do they compare everyone? By using their net worth.

What is net worth? It is the sum of all of an individual’s assets (positive number) and liabilities (negative number). In other words, everything you own minus what you owe. It’s also important to note that in order to grow financial wealth, it makes sense to track your financial decisions that contribute to your net worth.

Not all assets are created equal. Some appreciate while others depreciate. Take cars for example: cars are an asset, but it is a depreciating asset. How many times have you heard that after purchasing a car, it’s value instantly decreases as soon as you drive it out of the dealership lot? One’s net worth goes down with a car purchase. However, with real estate, an appreciating asset, although an investor incurs debt to purchase a property, the property’s value adds to a person’s net worth. The mortgage acts like a built in “investment plan” with each payment adding equity and lowers debt.

Now imagine having more real estate properties and also having someone else pay down the mortgage. How much faster would your net worth grow? Even better, what if the rent paid on the property was greater than property expenses and there was something left over every month generating positive cash flow! Wouldn’t that be amazing! Investing in real estate is definitely one sure way to grow net worth.

The Difference Between Financial Richness and Financial Wealth

What is the difference between financial riches and financial wealth? Financial riches are achieved through something high net income earners have – a big paycheck. Having a lot of money makes you rich. But there is a problem. Money is earned with your time; you are literally trading the prime years of your life working, to earn money. If you stop working, you stop being rich. In contrast, financial wealth is achieved through owning assets, creating and investing in opportunities that allow income generation for you. This aspect of having money “grow” more money for you is the essence of financial wealth.

My 2nd grader is just starting to discover the world before her and dreaming of finding the cure for childhood diseases, saving the planet from pollution, helping the less fortunate, feeding starving children… Remember those days when you had lots of time thinking about how you can make the world a better place? What about now? Are you pursuing those dreams? Instead of trying to live within your means, confined by your current paycheck, pursue ways that can allow you to live your dreams! What would financial wealth through real estate investment mean for you? Can you image the dreams that you can pursue once you have financial freedom? We invite you to join us and start the journey towards investing in your financial freedom. (Contact us to be added to our newsletter.)